CAMS Weekly View from the Corner - Week ending 8/2/24

August 5, 2024

Strewn throughout more editions than memory can serve we have intermittently offered two open-ended questions in the previous couple of years both of which inferred we would experience an economic setback, at some point, using history as our guide.

The first and by far the most consistent was very broad in scope which offered will policymakers be able to put an end to this price inflation era without an economic recession playing a role in its demise? History offers no of which we consistently shared.

The second is more drilled-down which offered can we continue to see Retail Sales come in negative report after report, when adjusted for price inflation, without it pointing to if not leading to recession? The significance here is when Retail Sales go consistently negative after adjusting for price inflation it suggests a struggling consumer backdrop.

It is important to keep in mind when operating in price inflation eras that a key driver of increased spending is the price inflation itself.

A way to clear out the price inflation noise in order to get a sense of what is occurring underneath the price inflation “growth” is to adjust retail sales growth by the price inflation growth rate.

This gives us the “real” retails sales growth rate or said differently, the price inflation adjusted growth rate. If after this adjustment the results continually offer negative growth rates it is a Tell that the consumer is not thriving as much as they are striving to keep up.

The Retail Sales results may look comfortably positive prior to inflation adjustment but said adjustment informs as to whether it is truly a positive growth rate and hence consumer backdrop or just a façade.

Below we look at this through the lens of the most recently updated data for both price inflation via the Consumer Price Index (CPI) and Retail Sales.

Above depicts Retail Sales adjusted for price inflation dating back to the inception of this price inflation era, circa early 2021.

Our red rectangle highlights the consistent negative price inflation adjusted Retail Sales dating back over two years ago. Our most recent update on this data denoted by the far right bar continued the consistent negative experience.

To get an appreciation for this through an historical lens below we broaden out the time frame depicted.

The above dates back to year 2000 as we continue with Retail Sales adjusted for price inflation. Our two large red rectangles note the customary experience whereby price inflation adjusted sales consistently reflect a positive growth rate.

While the consumer and the economy may not be thriving at any particular time within the boxes the data offers the consumer was not drowning under price inflation growth rate stress.

Per the faint grey vertical bars we see that when the collective consumer does become challenged, depicted by these negative real sales results, we are either in recession or entering into one. The faint vertical bars denote recessionary time frames.

Coming out of the Covid recession our red oval highlights the massive increase in price inflation adjusted Retail Sales as D.C. policymakers fanned free printed money throughout all areas of society.

To the right of our oval is our current time frame previously highlighted in our first chart.

With the broadened chart we can see how our current time period is an aberration and when consistent negative results unfold, such as we are experiencing in our current period, it offers a high probability of an economic setback. Importantly, high probability does not equal guarantee.

Thus far the economy has not officially recessed but as we have offered in previous editions how long can we see these types of results without a recession presenting itself?

The Employment Market

This past week we received the monthly updates on the employment market. ADP – the private payroll processor - released their results mid-week reflecting job gains continued to edge down on their growth trajectory.

Thursday we received the Weekly Unemployment Insurance Claims (one of our favorites) which noted an additional increase which has been developing into a trend attempt – more on these as developments unfold in near-term editions.

Friday the Bureau of Labor Statistics (BLS) released their results also chiming in on the weakening employment backdrop as fewer jobs were created than consensus expectations.

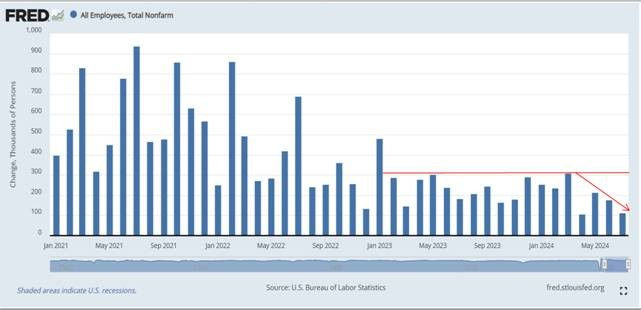

Below we get perspective using the inception of this price inflation era as our starting point.

The above depicts the results of the BLS Establishment Survey for new jobs created as each bar represent a monthly update.

Looking at the chart in totality we see the customary uneven growth of new employment. Similar to our 2nd Retail Sales chart above we can see numerous months of outsized growth of new employment coming out of the Covid recession – to the left of our red horizontal line.

Our red horizontal line also acts as a visual ceiling if you will whereby employment growth, while still quite positive clearly decelerated from lofty growth levels.

What is beginning to stand out is our red downtrend arrow which includes this past Friday’s employment release by the BLS. Unlike any other sequence in the depicted time we are now seeing a decelerating trend in employment growth dating back to early spring.

Wage Growth to Sales Growth to Employment

The employment market is weakening while Retail Sales adjusted for price inflation have been abysmal when placed in a historical context.

Wage growth rates, an often visited topic as well in these editions in recent years, had been negative when adjusted for price inflation for two full years. In the previous year they have turned positive but only marginally so.

These challenged wage growth rates when viewed through price inflation adjustments have left the everyday household challenged when they go into consumer mode and realize prices are out in front of their wages. With this price inflation adjusted Retail Sales have struggled. Being these two go hand-in-glove it is beginning to show up in the employment landscape.

Wages and consumption, when factoring in price inflation growth rates, cannot remain behind forever without the stress of such showing up throughout the economic system. We are now seeing the stress surface in the employment market.

While price inflation has come down as we begin to pierce through the 3% threshold we remain well north of the Fed’s traditional 2% target. Price inflation, albeit much better is still lurking around.

There will certainly be those who will offer the Fed waited too long to cut rates (if they haven’t already started) if the economy recesses.

This is nonsensical from the perspective that price inflation is the underlying issue of these challenges and it had hardly been beaten. With this the Fed should have ignored this reality and opened up the easy money spigots yet again, price inflation be damned? Silly talk.

This would have increased odds of enhancing the problem further. Price inflation turning upwards again would have been a knockout blow to the everyday household as they have already been struggling to keep up.

The true problem was the Fed waited too long to raise interest rates and stop the printing press therefore allowing the inflation genie to get out of the bottle. That’s the central mistake in this overall storyline – think “it’s transitory.”

We leave this edition where we started which is how we have left numerous editions over the previous two-plus years: Can this price inflation era be eradicated without incurring an economic setback? History offers no.

Perhaps it will be different this time but economic weakness is lurking around and price inflation is anything but dead.

I wish you well…

Ken Reinhart

Director, Market Research & Portfolio Analysis

Comments